If there’s one type of client that I get most excited about as a Realtor it’s the “I don’t think I can afford it” client. They might have responsibly paid rent for years, maybe have a savings account that stacks slooowly, or they just assume that owning a home is something that “other people'' do. Growing up my dad was a teacher, and we never owned a home—we lived in 6 rentals before I graduated high school. I think the biggest hurdles were mindset—thinking that it was a privilege that was financially out of reach for us—and ignorance of options that could get us there. With this as my personal background, it’s sharing these options that I get excited about, and there are a few such opportunities that I’d like to put out there today!

I’ve collaborated with Mark Daker from Ameris Bank on multiple transactions and he’s top-tier with communication and affordable options. Ameris is currently offering 3 programs I’ll highlight.

My favorite and the one I find most accessible is the Ameris DPA Grant (DPA=down payment assistance). If you qualify you can receive the lesser of 4% of the purchase price or $12,500 toward your downpayment—that’s a game changer! To qualify for this grant, your income can be up to 80% of the median income for the area you’re moving into. Can’t do that math in your head? Me neither! Use this look-up tool link to insert an address of interest and find out the magic qualifying number! I love this program because it’s a grant—they’re giving you money! Think about this program as the rich relative you wish you had who asks for you to be responsibly employed in return for helping you out with your first home purchase.

Another program is the Ameris Dream. This is a true 100% financed loan—meaning you don’t make a downpayment—and is a good option if you’re low on savings you can apply to a home purchase. There are two qualifiers for this one. You can either qualify by income—your income being up to 80% of the median, just like the DPA Grant—OR you can qualify by buying a home in an area (census tract more specifically) that is considered “low to moderate income.” Again, not something anyone knows off the top of their head, so I have a handy tool to find out if an area you’re interested in is considered “low to moderate.” Just enter the address in this link, click “Census Demographic Data” and look for “Tract Income Level” and there you have it!

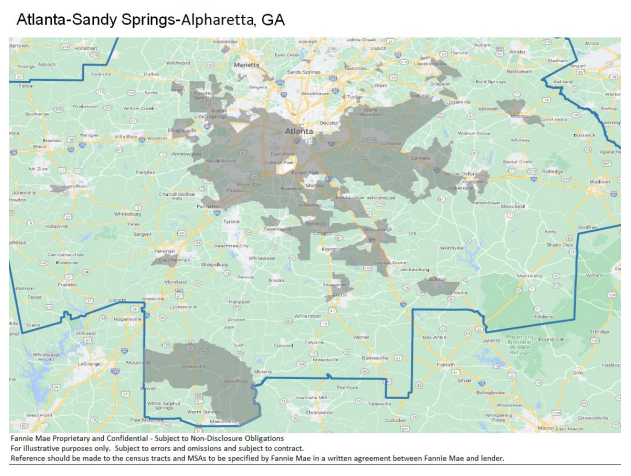

The last one I’ll mention is the Ameris Housing Equity Enhancement Program (Ameris HEE). This is a smaller niche as the major qualifier is that you currently live in an approved census tract. I’ll include a map, but it is dominantly south, metro Atlanta with a few smaller pockets in the northeast and northwest. There is no income limit and it’s a grant for the lesser of 4% or $12,500—again, a significant amount!

These programs are all being offered specifically to help under-served areas and/or to develop homeownership for buyers that traditionally struggle to afford housing. We’ll take it! Other qualifiers relate to your credit score, debt-to-income ratio, etc. but they all make the prospect of affording a home purchase so much more attainable!

There is more to be known about all of these programs and I want my clients coming into homeownership well-educated, so please reach out with questions or for more information and I'd be glad to share! Mark Daker—the excellent lender mentioned above—can be reached at mark.daker@amerisbank.com and more information about these programs can be found at Ameris-DPA Programs.

Interested in this program or ready to learn more about your home buying options? Let’s chat!